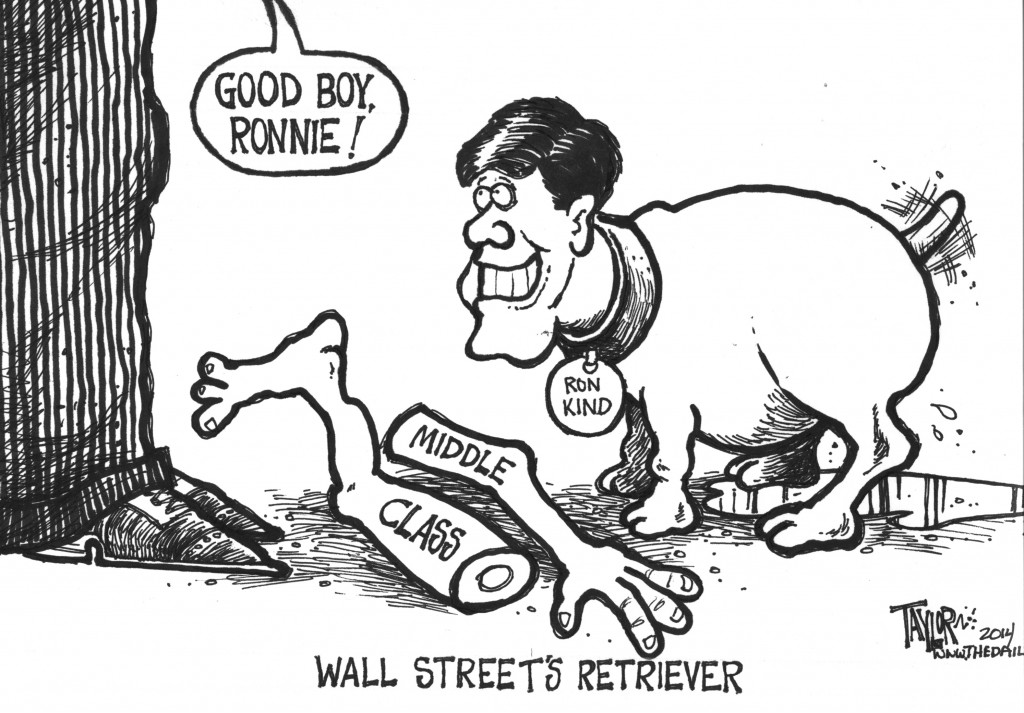

(Daily Call cartoon by Mark L. Taylor, 2014. Open source ad free to use with link to www.thedailycall.org )

By David Dayen

Naked Capitalism (2/1/16)

Third Way, the self-appointed sentries holding back the barbarians of progressivism from the gates of the Democratic Party, issued a new paper three days before the Iowa caucus, with the novel suggestion that Bernie Sanders’ proposal to expand Social Security – the consensus position among the party rank-and-file and a strong majority of the Congressional Democratic caucus – is “not progressive,” because more of its expanded benefits pass on to the rich.

This new tactic among Rubinite Democrats (Third Way’s funders include hedge fund managers Dan Loeb and Derek Kaufman, and their board features dozens of investment bankers and CEOs) seeks to capitalize on the Democratic base’s passions about the flow of economic growth upward to the 1%. And it will probably fool a few folks in the interim. But nobody is a more dishonest broker for that message than Third Way. Plus, the claim isn’t only ham-handed and ahistorical, it’s factually inaccurate.

Nancy Altman of Social Security Works took a hatchet to this over the weekend. First, she points out that Third Way has had it in for Social Security for years:

In a 2011 Politico column, “Progressives: Wise Up,” Third Way’s president and vice president for policylectured advocates for Social Security to stop fighting a Grand Bargain that would have cut Social Security’s modest benefits – cuts that are opposed by 93.8 percent of Americans.

In 2013, the duo took to the Wall Street Journal where they attacked Senator Elizabeth Warren for proposing to expand Social Security as a solution to the nation’s looming retirement income crisis. This time, they lectured not just progressives; they warned the entire Democratic Party not to “follow Sen. Warren…over the populist cliff.” Since Senator Warren was standing with the 90 percent of Democrats (and 73 percent of Republicans) who want to increase Social Security benefits, it was no surprise that Third Wayadmitted that they represented, “no people,” beholden only to their wealthy paymasters.

It’s hard to accept that the same group who tried to browbeat liberals into cutting Social Security benefits, particularly for poor women – who would have borne the brunt of the changes to the Consumer Price Index calculation – have a genuine interest in the relative fairness of any expansion. But having lost a frontal assault on the program, Third Way is now retreating to a bank-shot – raise doubts about the progressivity of new benefits to taint the entire concept.

Altman goes on:

Sanders, who daily attacks the “billionaire class,” is proposing to benefit the rich at the expense of the rest of us? Sound preposterous? That is because it is […]

Here is what Sanders’s plan would do. First, it would increase Social Security’s benefits across-the-board, but in a progressive manner. Those with the lowest earnings would receive the largest increases as a percentage of those earnings. Second, it would increase Social Security’s minimum benefit so that those who work a lifetime at low wages would not retire into poverty, as they do now. Third, it would adopt a more accurate cost of living increase, so that Social Security’s modest benefits don’t erode in value more and more with each passing year, as they do now. To restore Social Security to long range actuarial balance, including paying for these improvements, Sanders’ plan imposes new taxes on those with annual incomes in excess of $250,000.

Incredibly, Third Way’s entire issue brief never incorporates this lifting of the cap on the payroll tax above $250,000 into their analysis of the distributional impact. They only look at the benefits being paid out, not what gets paid in. Lifting the cap raises $11.9 trillion over 75 years, and only $3.4 trillion of that goes toward expanded benefits, with the rest putting the program closer to actuarial balance. So the same wealthy people who allegedly prosper more from expanded Social Security are the ones who will be paying for the expansion. More from Altman:

Third Way only mentions the increased Social Security revenue to make the specious point that the new proposed revenue will “crowd out” other social spending. But what Sanders is proposing is simply to require the wealthiest among us to pay the same rate on their incomes into Social Security as less well-off Americans. Right now, someone with an annual salary of around $1 million pays one-tenth the rate on those earnings paid by a minimum-wage worker on his or her earnings.

Protecting the richest

The expansion plan makes the program less regressive on the tax side, in other words. This gets written out of the story with a straight claim that the rich can’t afford to have this severe inequity corrected.

As Altman goes on to point out, Third Way isn’t even playing straight on the benefit side, to say nothing of ignoring the tax side. The report breaks beneficiaries into quintiles based on average lifetime income. But the top quintile income begins at a relatively paltry $63,000 a year. Looking at distributional impacts by lumping in everyone from the edge of the middle class to a multimillionaire does little to clarify anything.

Looking at the straight dollar amounts of support also obscures the percentage of replacement rate that beneficiaries receive in retirement. A high-income worker who pays more in gets some more out with their benefits. However, the replacement rate for the working poor is far higher than for the wealthy. Judged on these terms, the Sanders expansion plan remains highly progressive.

So when Third Way uses a sample case of a couple conveniently making $220,000 a year (inside the “doughnut hole” where the cap is not lifted) to highlight the inequity, they aren’t noting that, as a percentage of replacement rate, lower-income families fare much better.

Attack on needed universal benefit programs

At the root, this is really an attack on universal benefit programs, mainly because, God forbid, they parcel out to everybody. If anyone were to propose a Social Security expansion that only augmented benefits for the poor, with the rich paying for it, Third Way would be first in line to shout loudly about the gross unfairness of the redistribution of wealth.

They don’t like a universal program because it’s harder to break the national solidarity and funnel payroll contributions to Wall Street fund managers through privatization. And yes, programs for the poor are poor programs, particularly ones that primarily deliver cash assistance. For example, welfare, which supplements the bottom half of the poor, has been gutted, while tax credits for the working poor did OK. Isolating benefits to the poor is a good way to make recipients’ lives miserable (limits on withdrawals, drug testing, other forms of thinly veiled class discrimination) and to chip away at their benefits over time. By contrast, here’s what Franklin Roosevelt said about universal programs like Social Security over 80 years ago:

We put those pay roll contributions there so as to give the contributors a legal, moral, and political right to collect their pensions and their unemployment benefits. With those taxes in there, no damn politician can ever scrap my social security program. Those taxes aren’t a matter of economics, they’re straight politics.

“Straight politics” is a good way to describe Third Way’s gambit, too. They want to discredit liberal ideas, at a time when progressive power is being built through the presidential nomination. Beset by the left, the radical center has adopted the famous Karl Rove strategy of attacking their opponent’s strengths, to turn them into weaknesses. If Third Way has to mislead to get there, that’s of no consequence.