“The failure to dissect the cause of war leaves us open to the next installment.”

— Chris Hedges

(See “America’s Broken Service Academies”, below.)

— Chris Hedges

(See “America’s Broken Service Academies”, below.)

(Daily Call cartoon by Mark L. Taylor, 2015. Open source and free to use with link to www.thedailycall.oerg )

By William J. Astore

The Nation (8/18/15)

Thomas Jefferson Hall, West Point’s library and learning center, prominently features two quotations for cadets to mull over. In the first, Jefferson writes George Washington in 1788: “The power of making war often prevents it, and in our case would give efficacy to our desire of peace.” In the second, Jefferson writes Thomas Leiper in 1815: “I hope our wisdom will grow with our power, and teach us that the less we use our power, the greater it will be.”

Two centuries ago, Jefferson’s points were plain and clear, and they remain so today: while this country desired peace, it had to be prepared to wage war; and yet the more it avoided resorting to raw military power, the more it would prosper.

Have America’s military officers and politicians learned these lessons? Obviously not. In the 21st century, the United States unquestionably ranks number one on this planet in its preparations for waging war—we got that message loud and clear—but we’re also number one in using that power aggressively around the globe, weakening our nation in the process, just as Jefferson warned.

Of course, the world today is a more complex and crowded place than in Jefferson’s time and this country, long a regional, even an isolationist power, is now an imperial and global superpower that quite literally garrisons the planet. That said, Jefferson’s lessons should still be salutary ones, especially when you consider that the US military has not had a convincing victory in a major “hot” war since 1945.

There are undoubtedly many reasons for this, but I want to focus on two: what cadets at America’s military academies really learn and the self-serving behavior of America’s most senior military officers, many of whom are academy graduates. Familiar as they may be with those words of Jefferson, they have consistently ignored or misapplied them, facilitating our current state of endless war and national decline.

America’s Military Academies: High Ideals, Cynical Graduates

America’s military academies are supposed to educate and inspire leaders of strong character and impeccable integrity. They’re supposed to be showcases for America’s youth, shining symbols of national service. Ultimately, they’re supposed to forge strong military leaders who will win America’s wars (assuming those wars can’t be avoided, as Jefferson might have added). So how’s their main mission going?

I taught at the Air Force Academy for six years, and I’ve talked to former cadets as well as fellow officers who taught at Army’s West Point and the Navy’s Annapolis. Here are a few reflections on the flaws of these institutions:

In reality, the unstated primary mission of the three military academies is to turn raw cadets into career officers dedicated and devoted to their particular branch of service. On the other hand, service to the American people is, at best, an abstract concept. More afterthought than thought, it is certainly mentioned but hardly a value consistently instilled.

Careerism and parochialism are hardly unique to military academies. Still, as one former cadet wrote me, it’s surprising to encounter them so openly in institutions dedicated to “service before self.” More than a few of his peers, he added, were motivated primarily by a desire for “a stable, well-paying career.” Building a career in crypto trading requires market analysis skills, risk management, and staying updated with trends. Researching the best meme coins to buy today can unlock lucrative opportunities. Platforms offering insights into meme coins like Dogecoin, Shiba Inu, or emerging tokens help traders make informed decisions and achieve financial growth. While a perfectly respectable personal goal, to be sure, it’s a less than desirable one at academies theoretically dedicated to selfless, even sacrificial service.

The academic curriculum is structured to prepare cadets for the technical demands of their first jobs, meaning that it’s heavily weighted toward STEM (science/technology/engineering/math). Despite the presence of a Cadet Honor Code, the humanities and questions of ethics play too small a role in the intellectual and moral development of the students.

Cadets quickly learn that excelling within the system is the surest path to coveted opportunities—increasingly scarce pilot slots, Special Ops schools, or the like—after graduation. Educationally speaking, they are driven by the idea of advancement within the conformist norms defined by their particular academy and branch of service. A system that rewards energetic displays of conformity also tends to generate mediocrity as well as cynicism. As one former cadet put it to me, “There is something deeper and more perverse here as well: The ‘golden boys’ [in the eyes of Academy officialdom] got the coveted slots but were generally hated by their cynical peers. Cynicism seems to define the Academy experience.”

A former colleague of mine had this comment: “The [military] academies don’t make great people and they don’t always make good people better. I have seen them turn off a few really good people, however.”

Because the academies are considered prestige institutions as well as symbols of rectitude and their reputations are always at stake, few risks are taken. Misconduct, when it occurs, is frequently hushed up “for the good of the Academy.” Scandals involving cheating, sexual assaults, and religious discrimination have often been made worse by not being dealt with openly and honestly. Cadets know this, which is another reason many emerge from their education as cynics when it comes to the high ideals the academies are supposed to instill.

As schools, they are remarkably insular, insider outfits often run by academy graduates whose goals tend to be narrow and sometimes even bizarrely parochial. For example, I knew of one superintendent (a three-star general) at the Air Force Academy whose number one goal was a winning football program. In that sense, he certainly reflected American society: think of the civilian college presidents who desire just that for their institutions. But military academies are supposed to be about creating leaders, not winning football trophies—and the two bear remarkably little relationship to each other no matter how many times the Duke of Wellington is (mis)quoted about the Battle of Waterloo being won on the playing fields of Eton.

Finally, there’s a strong emphasis at all the academies on simply keeping cadets busy. To the point where—especially in their first year—they’re often sleep-deprived and staggering into class. Theoretically, this is meant to be a test both of their commitment to military life and their ability to handle pressure. Whether they learn anything meaningful while dazed or sleeping in class is not discussed. Whether this is a smart way to develop creative and strong-minded leaders is also not up for consideration.

As one former cadet put it: busywork and demanding rituals that sometime cross the line and become hazing are embraced in military education as a “rite of passage.” The idea “that we [cadets] suffered through something and prevailed is an immensely powerful psychological ‘badge’ which leads to pride (or arrogance) and confidence (or hubris).”

Add up the indoctrination and the training, the busywork in classrooms and the desire to excel in big-time collegiate sports, and what you tend to graduate is a certain number of hyper-motivated true believers and a mass of go-along cynics—young men and women who have learned to subsume their doubts and misgivings, even as they trim their sails in the direction of the prevailing winds.

While the cadets are encouraged to over-identify with their particular academy and service branch, they’re also encouraged to self-identify as “warriors,” as, that is, an elite apart from and superior to the civilians they’re supposed to serve. That this country was founded on civilian control of the military may be given lip service, but in the age of the ascendant national security state, the deeper sentiments embedded in an academy education are ever more distant from a populace that plays next to no part in America’s wars.

That the classic civilian-military nexus, which was supposed to serve and promote democracy, has turned out to have a few glitches in our time should surprise no one. After all, President Dwight Eisenhower warned us about what was coming back in 1961. As Ike noticed, the way it was working—the way it still works today—is that senior officers in the military too often become tools of the armaments industry (his “military-industrial complex”) even as they identify far too closely with the parochial interests of their particular service branch. Add to this the distinctly twenty-first-century emphasis on being warriors, not citizen-soldiers, and you have the definition of a system of self-perpetuating and self-serving militarism rather than military service.

To the extent that the military academies not only fail to curb this behavior but essentially encourage it, they are failing our democracy.

America’s Senior Officers: Lots of Ribbon Candy, No Sweetness of Victory

In my first article for TomDispatch back in 2007, I wrote about America’s senior military leaders, men like the celebrated David Petraeus. No matter how impressive, even kingly, they looked in their uniforms festooned with ribbons, badges, and medals of all sorts, colors, and sizes, their performance on the battlefield didn’t exactly bring to mind rainstorms of ribbon candy. So why, I wondered then, and wonder still, are America’s senior military officers so generally lauded and applauded? What have they done to deserve those chests full of honors and the endless praise in Washington and elsewhere in this country?

By giving our commanders so many pats on the back (and thanking the troops so effusively and repeatedly), it’s possible that we’ve prevented the development of an American-style stab-in-the-back theory—that hoary yet dangerous myth that a military only loses wars when the troops are betrayed by the homefront. In the process, however, we’ve written them what is essentially a blank check. We’ve given them authority without accountability. They wage “our” wars (remarkably unsuccessfully), but never have to take the blame for defeats. Unlike President Harry Truman, famous for keeping a sign on his desk that read “the buck stops here,” the buck never stops with them.

Think about two of America’s most celebrated generals of the twenty-first century, Petraeus and Stanley McChrystal and how they fell publicly from grace. Both were West Point grads, both were celebrated as “heroes,” despite the fact that their military “surges” in Iraq and Afghanistan proved fragile and reversible. They fell only because Petraeus was caught with his pants down (in an extramarital affair with a fawning biographer), while McChrystal ran afoul of the president by tolerating an atmosphere that undermined his civilian chain of command.

And here, perhaps, is the strangest thing of all: even as America’s wars continue to go poorly by any reasonable measure, no prominent high-ranking officer has yet stepped forward either to take responsibility or in protest. You have to look to the lower ranks, to lieutenant colonels and captains andspecialists (and, in the case of Chelsea Manning, to lowly privates), for straight talk and the courage to buck the system. Name one prominent general or admiral, fed up with the lamentable results of America’s wars, who has either taken responsibility for them or resigned for cause. Yup—I can’t either. (This is not to suggest that the military lacks senior officers of integrity. Recall the way General Eric Shinseki broke ranks with the Bush administration in testimony before Congress about the size of a post-invasion force needed to secure Iraq, or General Antonio Taguba’s integrity in overseeing a thorough investigation of prisoner abuse at Abu Ghraib. Their good deeds did not go unpunished.)

Authority without accountability means no one is responsible. And if no one is responsible, the system can keep chugging along, course largely unaltered, no matter what happens. This is exactly what it’s been doing for years now in Iraq, Afghanistan, and elsewhere.

Can we connect this behavior to the faults of the service academies? Careerism. Parochialism. Technocratic tendencies. Elitism. A focus on image rather than on substance. Lots of busywork and far too much praise for our ascetic warrior-heroes, results be damned. A tendency to close ranks rather than take responsibility. Buck-passing, not bucking the system. The urge to get those golden slots on graduation and the desire for golden parachutes into a lucrative world of corporate boards and consultancies after “retirement,” not to speak of those glowing appearances as military expertson major TV and cable networks.

By failing to hold military boots to the fire, we’ve largely avoided unpleasantness between the military and its civilian leadership, not to speak of the American public. But—and here’s the rub—70 years of mediocrity since World War II and 14 years of failure since 9/11 should have resulted in anti-war protests, Congressional hearings, and public controversy. It should have created public discord, as it did during the Vietnam War, when dissent was a sign of a healthy democracy and an engaged citizenry. Nowadays, in place of protest, we hear the praise, the applause, the thank-yous followed by yet another bombastic rendition of “God Bless America.” Let’s face it. Our military has failed us, but haven’t we failed it, too?

Listening Again to Jefferson

America’s military academies are supposed to be educating and developing leaders of character. If they’re not doing that, why have them? America’s senior military leaders are supposed to be winning wars, not losing them. (Please feel free to name one recent victory by the US military that hasn’t been of the Pyrrhic variety.) So why do we idolize them? And why do we fail to hold them accountable?

These are more than rhetorical questions. They cut to the heart of an American culture that celebrates its military cadets as its finest young citizens, a culture that lauds its generals even as they fail to accept responsibility for wars that end not in victory but—well, come to think of it, they just never end.

The way forward: I don’t have to point the way because Thomas Jefferson already did. Just read his quotations in the West Point library: we need to become a peace-loving nation again; we need to act as if war were our last resort, not our first impulse; we need to recognize that war is corrosive to democracy and that the more military power is exercised the weaker we grow as a democratic society.

Jefferson’s wisdom, enshrined at West Point, shouldn’t be entombed there. We need a new generation of cadets—and a few renegade generals of my generation as well—who want to serve us by not going to war, who know that a military is a burden to democracy even when victorious, and especially when it’s not. Otherwise, we’re in trouble in ways we haven’t yet begun to imagine.

By Thom Hartmann

ThomHartmann.com (8/19/15)

Ann Coulter knows who she wants to be the Democratic nominee for president, and who that person is, well, it may surprise you.

She wants Hillary Clinton to be the nominee, and thinks that if Bernie gets the nod, he’ll beat whoever the Republicans come up with to run against him.

You won’t hear me say this often, but Ann Coulter is right.

If Bernie Sanders ends up being the Democratic nominee for president, and it looks more and more every day like he will be, his Republican opponent is going to have a very hard time beating him.

And that’s because of all the Democratic candidates running, Bernie Sanders has the best chance of capturing Republican votes.

I’ve seen how Bernie does this, up close and personal.

Despite its reputation as a place filled with liberal hippies, Vermont, like most of rural northern New England, is home to a lot of conservatives.

Anyone running for statewide office there needs to win these conservatives’ votes, and Bernie is great at doing that.

Back in 2000 when Louise and I were living in Vermont, it wasn’t all that uncommon to see his signs on the same lawn as signs that said “W for President.”

Seriously, I’m not kidding.

And as NPR’s “Morning Edition” found out last year, some of Bernie’s biggest fans are in Vermont’s Northeast Kingdom, the poorest and most conservative part of the state.

It’s people from the Northeast Kingdom who’ve overwhelmingly elected Bernie to almost 20 years in Congress and two straight terms as senator, and it’s people like them in the rest of the country who will probably send Bernie to the White House if he gets the Democratic nomination for president.

So why is that?

Why is Bernie Sanders, a socialist, so popular with people who should hate “socialism?”

The answer is pretty simple.

While Americans disagree on social issues like gay marriage and abortion, they’re actually pretty unified on the bread and butter economic issues that Bernie has made the core of his campaign.

In fact, a recent poll by the Progressive Change Institute, shows that Americans overwhelmingly agree with Bernie on key issues like education, health care and the economy.

Like Bernie, 75 percent of Americans poll support fair trade that “protects workers, the environment and jobs.”

Seventy-one percent support giving all students access to a debt-free college education.

Seventy-one percent support a massive infrastructure spending program aimed at rebuilding our broken roads and bridges, and putting people back to work.

Seventy percent support expanding Social Security.

Fifty-nine percent support raising taxes on the wealthy so that millionaires pay the same amount in taxes as they did during the Reagan administration.

Fifty-eight percent support breaking up the big banks.

Fifty-five percent support a financial transaction or Robin Hood tax.

Fifty-one percent support single payer health care, and so and so on.

Pretty impressive, right?

And here’s the thing - supporting Social Security, free college, breaking up the big banks, aren’t “progressive” policies, they’re just common sense, and 60 years ago they would haveput Bernie Sanders smack dab in the mainstream of my father’s Republican Party.

This is why Ann Coulter is so scared of Bernie becoming the Democratic nominee.

She knows that he speaks to the populist, small “d” democratic values that everyday Americans care about, regardless of their political affiliation.

That’s the really radical part of Bernie’s 2016 campaign, and what’s what maybe, just maybe, might make him the 45th President of the United States.

Link to Story and 4+-Minute Video

By George Zornick

The Nation (8/20/15)

The Trans-Pacific Partnership is in its final stages, though nobody seems certain when talks over the massive trade deal will actually conclude. The document is undergoing critical late-stage revisions as member nations haggle over the automobile trade with Japan, dairy prices in New Zealand, and monopoly periods for non-generic pharmaceuticals.

Locked in a basement

When the deal is completed, members of Congress will be able to see the entire text without restriction before they vote on passage. But until then, legislators are operating under hyper-strict rules when they want to review the text, which is locked in a basement room of the US Capitol. Only certain congressional aides with security clearances can see the TPP draft, and only when the member of Congress is also present. Notes taken during these sessions can’t be taken out of the room.

This has consistently irritated members of Congress, especially those already suspicious of the wide-reaching pact. Their aggravation is especially sharp now that the deal is nearing completion—this is the period in which legislators can actually influence the shape of the document. Once the deal is signed, Congress will not be able to amend the TPP, as per the rules of the fast-track legislation passed earlier this summer, and the deal will only need a simple majority in the Senate.

One senator acts

Senator Sherrod Brown recently gave the administration a deadline to ease some of these restrictions. He wants his policy advisors to be able to evaluate the evolving text without having him present. But that access was never given, and his self-imposed deadline passed last Friday.

Brown has consequently announced he will place a hold on Obama’s nominee to be Deputy US Trade Representative.

“The Administration would rather sacrifice a nominee for a key post than improve transparency of the largest trade agreement ever negotiated,” Brown said in a statement. “This deal could affect more the 40 percent of our global economy, but even seasoned policy advisors with the requisite security clearance can’t review text without being accompanied by a Member of Congress. It shouldn’t be easier for multinational corporations to get their hands on trade text than for public servants looking out for American workers and American manufacturers.”

The nominee, Marisa Lago, is otherwise facing an easy confirmation process in the Senate. Her confirmation hearing before the Senate Finance Committee was generally pleasant and no serious opposition has mobilized against her.

OUr representative, no. But yes to corporate obbyists!

Brown has repeatedly brought up this complaint, including during hearings with US Trade Representative Michael Froman. During a hearing in April, Brown noted that “Staff can get access, often, to [Department of Defense] documents, to Iran sanction documents, to CIA briefings, but we can’t get access to Trans-Pacific Partnership text.”

Meanwhile, as Brown and other opponents have pointed out, close to 600 corporate executive and lobbyists enjoy wide-ranging access and input to the draft text.

Lago, it should be noted, worked for five years as an executive at Citigroup in the mid-aughts. Froman also hails from Citigroup, and even received a bonus from the bank when he entered government service at the start of the Obama administration. But this has not, to date, become a sticking point for Lago’s nomination.

By Sen. Bernie Sanders

Wall Street’s greed, recklessness, and illegal behavior drove this country into the worst recession since the Great Depression. For too long, this billionaire class has corrupted our political system. We must act decisively to make our economy fair again.

Wall Street’s dangerous manipulation of our economy has helped divert most of all new income to the top one percent, contributing to the most unequal level of wealth and income distribution of any major country on earth.

Today, we live in the richest country in the history of the world, but that reality means little because much of that wealth is controlled by a tiny handful of individuals. The skyrocketing level of income and wealth inequality is not only grotesque and immoral, it is economically unsustainable.

The reality is that for the past 40 years, Wall Street and the billionaire class have rigged the rules to redistribute wealth and income to the wealthiest and most powerful people in this country. As a result, Wall Street exists as an island unto itself, benefiting only the extremely wealthy while using our money to get rich.

Tax Wall Street Speculation to Make College Tuition Free

Too many firms on Wall Street using high-speed trading to try to make a quick buck. But it’s risky and unproductive. Banks can execute thousands of stock trades a second thanks to sophisticated computer algorithms.

Wall Street can keep doing this if it wants—but they’ll have to pay a tax on every one of those trades. And this tax on Wall Street speculation would be enough to pay for my plan to make tuition free at every public college or university.

Break Up Banks that are Too Big to Fail

In the midst of all of this grotesque inequality in our country sits a handful of financial institutions that are still so large, the failure of any one would cause catastrophic risk to millions of Americans and send the world economy into crisis.

Most of the major Wall Street financial institutions that we bailed out because they were “too big to fail” are now bigger than they used to be. The six largest financial institutions now have assets equivalent to nearly 60% of our GDP, issue 35% of the mortgages, and oversee 65% of credit cards.

My view: If it’s too big to fail, it’s too big to exist. That’s the bottom line. As president, I will break up the big banks and restore some sanity to our banking system.

Make Banking Boring: Reign in the Recklessness

Banking should be boring. It shouldn’t be about making as much profit as possible by gambling on esoteric financial products. The goal of banking should be to provide affordable loans to small and medium-sized businesses in the productive economy, and to Americans who need to purchase homes and cars.

That is not what these huge financial institutions are doing. They’re instead creating an economy which is not sustainable from a moral, economic, or political perspective. It’s a rigged economy that must be changed in fundamental ways.

We need banks that invest in the job-creating productive economy. We do not need more speculation with the American economy hanging in the balance.

Unrig the Tax System

Our tax system is wildly unfair — rigged to benefit the very rich. Major corporations that earn billions in profits stash their money in tax havens and pay nothing in federal income taxes, while billionaire hedge fund managers pay a lower effective tax rate than nurses or teachers. Earning money and generating profits in a casino requires skill, strategy, and luck. However, players must remember that winnings are subject to income tax, depending on local laws. A casino not on GamStop provides unrestricted access, but players should still be mindful of their tax obligations to ensure compliance.

In order to reverse the massive transfer of wealth and income from the middle class to the very rich that we have seen in recent years, we need real tax reform which makes the wealthy and profitable corporations begin to pay their fair share of taxes. It is fiscally irresponsible that the U.S. Treasury loses about $100 billion a year because corporations and the rich stash their profits in the Cayman Islands, Bermuda and other tax havens.

We need a tax system which is fair and progressive. Children should not go hungry in this country while profitable corporations and the wealthy avoid their tax responsibilities.

We Can Do This

The issue of wealth and income inequality is the great moral issue of our time, it is the great economic issue of our time, and it is the great political issue of our time.

I can understand how this might feel daunting. We are up against a billionaire class that has bought our political system to enrich itself, and is now faced with the breakup of their oligarchy.

Know this: when people come together to organize, we can beat any amount of money thrown around by the Koch Brothers, Goldman Sachs executives, or anyone else.

Our political revolution is underway, and when it is built, we will win not just against Wall Street, but we will win the White House.

Add your name to endorse Sanders Plan to take on Wall Street and the billionaire class.

By Trevor Timm

The Guardian (8/20/15)

Donald Trump offends entire voting blocks at will, constantly gets his facts wrong, and most of his policy positions are either contradictory or insane. Yet, on some issues, he’s also right.

His deliberate forays into xenophobia and arrogance on immigration and foreign policy certainly remain awful and ugly, but there’s also another reason he continues to sit atop the Republican polls: he speaks a particular kind of truth about some issues the way only someone with no filter can. These days, his venom particularly stinging to other Republicans, whom he has no problem attacking with a delightful abandon that is usually considered sacrilegious in inter-party primaries.

Or as Jon Stewart described it: “Trump has no control over the projectile vomit of dickishness that comes out of his mouth every time he opens it. It was inevitable that some of his word-puke was going to get on [Republicans].” And sometimes it’s just fun to watch. You can despise the man and dread his presidency, but still enjoy the show.

His criticism of “frontrunner” Jeb Bush – who is really only the frontrunner in the minds of billionaires – have been spot on, yet not something any of the other candidates would dare say for fear of denigrating the last two Republican presidents, Jeb’s brother and father. Trump took credit for the record audience during the first GOP debate by remarking, “Who do you think they were watching? Jeb Bush?” He’s right – Bush is boring. And I don’t mean boring in the technocratic, attention-to-details way. I mean he is mind-numbingly unoriginal and can’t even express those unoriginal ideas in a politically adept manner.

Hammering the Bushs

Trump has not minced words on George W Bush’s Iraq War, either, calling it the “disaster” that it was and is, and hammering Jeb for his stumbling defense of his brother’s war and its decade-long aftermath.

And when Trump posted a mash-up video on of the Bush family presidency on Instagram saying “Enough is enough - no more Bushes!” he nailed it. (Granted, Trump’s “solutions” for the second and third Iraq wars is beyond reckless and borderline sociopathic. For Isis, he prescribes re-invading Iraq and “stealing” all of their oil fields, and he claims “we should’ve invaded Mexico” instead of Iraq the first time.)

And then there are the Super Pacs. Has there ever been a more effective criticism of money in politics than Donald Trump? No one has shed more light on the money-funneling mechanisms for legally bribing politicians since Stephen Colbert. Trump knows wealthy people have inordinate power to influence elections, because he is usually one of them.

Buying politicians

When questioned and criticized for donating to Hillary Clinton and other democrats, Trump didn’t hide from it or apologize; he openly bragged about it: of course he donated to Democrats, because he was buying access and the politicians therefore had to kowtow to him.

Trump has no problem brazenly calling out the other Republican candidates, who spend their time sucking up to billionaires, either. “I wish good luck to all of the Republican candidates that traveled to California to beg for money etc. from the Koch Brothers. Puppets?” he tweeted. You’re not going to find more truth in any statement this election in 140 characters or fewer.

Trump also doesn’t try to hide his support for Social Security and Medicare, or pretend he’d push for massive cuts of two of the most popular social welfare programs that have ever existed, unlike almost all of his fellow Republicans. Instead, he scolded his opponents for even considering it: “I am actually disappointed with a lot of the Republican politicians,” he said. “Whether it is we are going to cut Social Security, because that’s what they are saying. Every Republican wants to do a big number on Social Security, they want to do it on Medicare, they want to do it on Medicaid,” he continued. “And we can’t do that. And it’s not fair to the people that have been paying in for years and now all of the sudden they want to be cut.”

His opponents may brand him a “moderate” or “Rino”. But what does Trump care? Support for those social programs is a really popular position, even within the Republican party. As the National Journal reported in April, “A United Technologies/National Journal Congressional Connection poll from January of 2012 found that among white working-class men and women, the bedrock of the GOP base, more than 80% said they didn’t think the program should be cut to ease the deficit.”

Calling out the dummies

Even some of his more childish insults of other candidates have some truth. He demanded that the Republican Party issue an IQ test to Rick Perry before letting him enter the debate. Say what you want about The Donald’s own intellect; he’s right that Perry is so dumb he should be disqualified from the presidency.

And when Donald Trump said Lindsay Graham “doesn’t seem like a very bright guy…I think Rick Perry honestly is smarter than Lindsey Graham,” he might be right, too. While Lindsay Graham certainly talks a better game than Rick Perry, he has been wrong – and many times unhinged – on almost every issue on foreign policy in the last decade, a subject which is supposedly his only strength.

In the coming weeks, Trump will inevitably say something horribly offensive to a particular person or group – that’s what he always does. But when the conventional wisdom machine then proclaims his campaign can’t possibly survive, remember there is a reason they will once again likely be wrong.

By Ben Jacobs

The Guardian (8/19/15)

Donald Trump has shaped the Republican presidential primary in his image.

Regardless of where his candidacy goes from here, his two months of active campaigning have already placed an irrevocable stamp on the nominating process. The businessman has not just determined the issues that his fellow candidates debate but had a suffocating effect on the race, draining attention from all of his rivals.

The most dramatic effect that Trump’s campaign has had already is to focus the Republican debate on immigration and dramatically shift the Overton Window – the politically viable spectrum of debate – on the issue. While the Republican base had long been opposed to comprehensive immigration reform and doomed any attempt for such legislation to pass on Capitol Hill, Trump has moved the debate dramatically. Where once Republicans contemplated whether it was appropriate for any illegal immigrant to be put on a path to citizenship, they are now focused on the merits of mass deportation and ending birthright citizenship.

Mark Krikorian, the head of the Center for Immigration Studies, a non-profit which seeks to reduce immigration into the United States, told the Guardian Trump has had “a significant effect” on the discussion and heralded the candidate’s role.

Krikorian said that Trump had had a huge effect on the national conversation with his announcement speech, in which he gave his “usual Trumpist exaggerations” about “Mexico sending all its rapists to the United States”, in combination with the July murder of Kate Steinle, a 33-year-old San Francisco woman who was allegedly shot by an illegal immigrant with seven felony convictions who had previously been deported five times. In his opinion, the confluence of the two has already forced the House of Representatives to pass a bill cracking down on so-called “sanctuary cities”, where city ordinances prevent police from asking about the immigration status of those they arrest, as well as pushed Jeb Bush to harshly condemn them.

Walker falls into line

Trump’s immigration plan, unveiled Sunday, has had further impact. It has already led Wisconsin governor Scott Walker to back a push to end “birthright citizenship”, a principle which almost all constitutional scholars think is enshrined in the 14th Amendment. Krikorian noted that while Walker had initially staked out “a hawkish position [on immigration] … he didn’t follow up” until now.

But Trump isn’t just pushing the field to talk about immigration in more strident terms. His presence in the race also changes other topics of debate. Two of the biggest non-Trump political news stories of the summer have been the Obama administration’s controversial nuclear deal with Iran and the emergence of hidden camera videos showing employees of Planned Parenthood discussing the sale of fetal tissue obtained through abortion for medical research. But, as Noah Rothman noted in Commentary last week, both of these issues have been buried by the Trump juggernaut, even though they are of vital concern to the Republican base. After all, these are not comfortable topics of discussion for the formerly pro-choice real estate mogul who gets his military advice from Sunday morning talk shows and they make for far less entertaining stories than Trump’s latest feud with a fellow candidate or television host.

But the rise of Trump to the front of the pack has also frozen the Republican field and prevented many of his rivals from getting their moments in the sun. Since his entry into the race, he has received far more media coverage than any other candidate. The result has meant that with the exceptions of Carly Fiorina, who had a hugely successful performance in the first debate, and John Kasich, who didn’t declare his candidacy until after Trump, every other Republican in the race has flatlined or declined in national polls since Trump’s entry in the race.

Eclipsing the opposition

His rise to the top has not even yielded any success for candidates with similar views. Rick Santorum, whose emphasis on reducing both legal and illegal immigration and increasing manufacturing jobs makes him perhaps the most similar Republican to Trump (to the extent, of course, that anyone can be like Trump) has continued to poll poorly. Further, fellow outsider Ben Carson has been revived by a strong closing argument at the GOP debate, to inch back up to the same standing he held when Trump first became a candidate

Ironically, the focus on Trump may help those candidates that he most loathes. The three Republicans long viewed as the most likely standard bearers for their party, Jeb Bush, Marco Rubio and Scott Walker, have been subject to far less scrutiny than would have otherwise been the case.

In the short term, though, Trump has also whitewashed his reputation among GOP primary voters. The percentage of Republicans who view the real estate mogul favorably has dramatically increased during the past few months and unfavorable numbers have declined. While he is still viewed unfavorably by a large swathe of Republican primary voters, opinion of him has swung dramatically in the past few months, with one polling company showing Trump’s approval rating improving by 45 points. And his unfavorable rating dropped from 56% to 35% between April and July. The result is that Trump has established himself as an important figure on the right for the foreseeable future.

It is impossible to predict quite how or even if the Trump phenomenon will end. Every aspect of his campaign has been increasingly unbelievable, from his helicopter to somehow becoming the first Republican ever to pick a fight with Fox News and end up winning. But, regardless of what happens, he has already placed his stamp as firmly on the 2016 Republican primary as he did on the Atlantic City boardwalk.

By Dan Peak

Special to the Daily Call (8/21/15)

For months (years?) I have marveled at Gov. Walker’s political appetite and where he has applied his energy. Is it so easy to be Governor that little time in the state is needed? It was clear following his election that his ambition was beyond Madison but that wasn’t for us to know in advance. But this is not new or damning, wouldn’t we be well served by a politician that chose to run for a higher office on the merit of his/her accomplishments, how he/she benefited their constituents, left their prior address in better shape than when they entered office?

We see personal ambition trump concern for constituents every day. As an example, now that Carly Fiorina is climbing in the polls we’re due to hear a LOT about how she “benefited” Hewlett-Packard - it will not be pretty and but it will cause many of us to forget Herman Cain or maybe even Paul Ryan or Michele Bachmann, at least for a little while.

Ron Kind

Much closer to home, why was Congressman Ron Kind the guest of the Israeli government? I know he didn’t make the trip alone but doesn’t that make the exercise more damning? The trip was so enlightening his press release told us he “hadn’t made up his mind how he’d vote” but did ladle out Benjamin Netanyahu rhetoric that he could have gotten from his notes from Netanyahu’s address to Congress. Kind’s press release did remind us there is some political figure in Iran that still says crazy stuff about the US and Israel and that (might) merit scrapping the proposed Treaty. A Treaty that meets the stated goal of pushing out the timeline for a Iranian nuclear weapon - but scrapped because…some other plan would make ‘us’ safer? Or maybe Congressman Kind is politically savvy and is trying a ‘cake-and-eat-it’ approach - there is no vote as yet so right now stand resolute and tough (if not accurate or well considered). I tire of the double standard that says Israeli spy Jonathan Pollard is a hero and his acts of treason virtuous - even if the Russians did learn a lot about us. To avoid further digression, here’s an interesting view of Pollard:

http://www.economist.com/news/

Walker in 3D

So what is new? We are now seeing the early version of Walker-for-President. I don’t mean the 2D hand-shaking, baby-kissing pretty pictures version. We now see the makings of a 3D image. As we strive to bring this into focus we see parts and pieces - he claims a history as a race unifier for Milwaukee, he favors the Milwaukee Bucks over funding for higher education, he knows little about foreign policy but assures us he will out-W Bush when it comes to fighting for us, whatever the definition of War du jour. For us he’s already fought teachers, Democrats, Unions and now we hear, even his own party. Whatever it takes - for us.

Am I to respect Gov. Walker for his raw ambition? How should I feel about his accomplishments on our behalf, his legacy (for now)? Should I respect him for his passion that will now have to become Passion for him to stay as a viable GOP presidential candidate or at least donor-viable? How do I weigh his ambition against his lack of knowledge of foreign relations or his history of ready-for-vote ALEC legislation passed in a any-way-possible democratic process and open government-be-damned way? Do I trust his one-page plan to replace the Affordable Care Act because of how well he met his goals for employment growth and a balanced budget - I mean his math and details do seem a bit fuzzy but not so much so in the realm of political ambition. And he makes doing his job as Governor look easy - as if it’s his after-school extracurricular activity while his primary focus is on something else - such ease and, well, passion.

So much more to watch. Can Walker re-energize his campaign and donors? Have Fox and Trump really made up? Have we really heard the last of Rick Perry and Rick Santorum or can they muster one last outlandish statement that will draw focus (and sponsors) back to their campaigns? When all the comments are in, how tall will the Wall be and where will they put the Golden Door? Will Huckabee’s battle plan for Planned Parenthood catch on or will we discover new more virulent enemies to smote?

As Matt Taibbi of The Rolling Stone said recently, “it’s like watching 17 platypuses try to mount the queen of England. You can’t tear your eyes away from it.”

The Guardian (8/20/15)

Former reality TV star Josh Duggar has admitted to being “the biggest hypocrite ever” in being unfaithful to his wife, Anna, a day after he was revealed to have allegedly held an account on the Ashley Madison spousal cheating site.

Duggar and his family rose to fame as the stars of the TLC show 19 Kids and Counting, which was taken off the air in May after it was revealed that as a teenager, Duggar had molested underage girls.

Duggar and his parents, Jimbob and Michelle Duggar, posted a statement on the family website on Thursday, a day after Gawker said it had found his name among the 33m account details of Ashley Madison customers whose information was released by hackers this week.

“I am so ashamed of the double life that I have been living and am grieved for the hurt, pain and disgrace my sin has caused my wife and family, and most of all Jesus and all those who profess faith in Him.”

Duggar and his wife were married in 2008 and have four children.

He is the oldest of 19 children in the Duggar family, whose conservative Christian Arkansas upbringing was featured on the TLC show. When allegations of child molestation were first revealed in May, he resigned from his job at the Family Research Council, a conservative lobbying group based in Washington DC, and issued a statement in which he said he felt remorse for “wrongdoing”.

“Twelve years ago, as a young teenager, I acted inexcusably for which I am extremely sorry and deeply regret. I hurt others, including my family and close friends,” Duggar said at the time.

The Duggar family have associated with and campaigned for a number of prominent Republican politicians – including Mike Huckabee, in Iowa in 2008.

The data from Ashley Madison, whose tagline is “Life is short. Have an affair”, was released by hackers from the Impact Team cybergroup, and took the form of a 10GB database on the “dark web” that could be accessed through a specialised web browser called Tor.

One coder then created a site for internet users where it was possible to enter a specific email address to see if that matched a customer record, potentially allowing spouses to check whether their partners had an account on the controversial site.

By Ed Mazza

The Huffington Post (8/20/15)

A conservative radio talk show host in Iowa wants to turn undocumented immigrants into “property of the state” and forced into labor.

“Put up a sign that says at the end of 60 days, if you are not here with our permission, can’t prove your legal status, you become property of the state,” Jan Mickelson said during his show on Monday. “And then we start to extort or exploit or indenture your labor.”

Audio of Mickelson’s segment was posted online by Media Matters.

When a caller said “it sounds an awful lot like slavery,” Mickelson asked: “Well, what’s wrong with slavery?”

He also claimed that Americans are “indentured” to undocumented immigrants by supposedly being forced to pay their expenses.

Mickelson said the undocumented immigrants could be housed in tents, similar to the “Tent City Jail” set up by Maricopa County, Arizona, Sheriff Joe Arpaio.

“Put up a tent village, we feed and water these new assets, we give them minimal shelter, minimal nutrition, and offer them the opportunity to work for the benefit of the taxpayers of the state of Iowa,” Mickelson said. “All they have to do to avoid servitude is to leave.”

In another excerpt posted by Media Matters, he also suggested that the “slaves” could be forced to build a wall across the Mexican border:

“We say, ‘Hey, we’re not going to make Mexico pay for the wall, we’re going to invite the illegal Mexicans and illegal aliens to build it. If you have come across the border illegally, again give them another 60-day guideline, you need to go home and leave this jurisdiction, and if you don’t you become property of the United States, and guess what? You will be building a wall. We will compel your labor. You would belong to these United States. You show up without an invitation, you get to be an asset. You get to be a construction worker. Cool!'”

Mickelson also insisted his proposal was serious.

“You think I’m just pulling your leg,” he told the caller. “I am not.”

Listen to his comments in the clip above, or read more of the transcript at Media Matters.

Mickelson has a history of both xenophobic and homophobic comments. Earlier this year, he said undocumented children should be banned from public schools. And in 2012, he said gays “are likely to shorten their lives in this world and impair their destinies in the next.”

However, his talk show is influential among conservatives in the state and Republican presidential hopefuls routinely appear on the broadcast.

We have spent the last six years constantly criticizing the Governor and his Party, justifiably so. In the process, however we have neglected the voter. They don’t know what the Democratic Party stands for because we aren’t telling them. There are several studies that show that, in the absence of information, people will choose what they know over what they don’t know, even if the former is bad. And, clearly voting for this governor has been very, very bad.

We must give the voter reasons to vote for progressive Democrats. I believe that Scott Wittkopf’s value-based messaging workshop, based on George Lakoff’s cognitive science research, will help us do just that. This is not an easy endeavor, because we have to learn a new way to speak. But, what do we have to lose? What we’ve been doing isn’t working. And, the shortage of progressive Democrats in the legislature to counter the ALEC-based bills has hurt the citizens of our state tremendously.

I am inviting you to a messaging workshop being held on Saturday, August 22 in Richland Center at our Party headquarters. The workshop starts at 1:00 PM and ends at 5:00 PM. Scott put together an excellent agenda of interactive message training that should be fun and informative. I attended a different workshop presented by Scott and I can attest to its benefit.

Please consider joining us for this very important workshop. Let me know as soon as possible if you can make it: email Ernie— [email protected]

Working together for the win in 2016.

Ernie Wittwer

Richland County Democratic Party

The Onion (8/20/15)

IOWA CITY, IA—Just minutes before taking the stage for a town hall event Friday, Republican presidential candidate Lindsey Graham reportedly chastised himself upon realizing he had left the CD-R containing his campaign song in his room at the Red Roof Inn.

“Darn it, I even put it on the bedside table so I wouldn’t miss it when I was getting dressed to leave,” said Graham, who was hopeful that housekeeping would place the CD-R in the lost and found since he had written “Lindsey’s Campaign Song” on the disc with a black felt-tip marker. “There’s no time to head back now. Shoot, I can picture it sitting there, right next to the little cardboard envelope with the second keycard in it. Now I’ll have to get my sister to burn another CD for me.”

At press time, Graham reportedly walked out onto the stage to complete silence.

— Adolph Hitler

(See “Gov. Ditto”. below.)

By Jenna Johnson & Sean Sullivan

Washington Post (8/19/15)

Scott Walker has sought to reassure jittery donors and other supporters this week that he can turn around a swift decline in the polls in Iowa and elsewhere by going on the attack and emphasizing his conservatism on key issues.

In a conference call, one-on-one conversations and at a Tuesday lunch, the Wisconsin governor and favorite of anti-union conservatives told backers that his campaign is shifting to a more aggressive posture and will seek to tap into the anti-establishment fervor fueling the rise of Donald Trump and other outsider candidates.

During a conference call with top fundraisers Monday afternoon, Walker and his campaign manager were relatively candid in their assessment of the campaign’s shortcomings, according to notes of the conversation taken by a participant. Walker said the campaign will strive to do better in three areas: protest, passion and policy.

“We need to step it up and remind people that we didn’t just take on the unions and Democrats, we had to take on my own party establishment, those who did not want to take on the status quo,” Walker said on the call, according to the notes.

He added later: “One thing I heard about the first debate was: ‘You were fine, you did no wrong, but people want to feel the passion.’ ”

Out righting the right

The steps mark a clear shift for a candidate who has long positioned himself as a potential bridge between the party’s conservative and establishment wings. Walker now intends to focus his energy primarily on challengers from the right — a constituency that is particularly important in the first-in-the-nation Iowa caucuses, which aides consider a must-win contest for him.

Despite Walker’s strong and consistent start earlier this year, he has quickly lost ground in recent weeks and put in an underwhelming performance at the first GOP debate, on Aug 6. He went from double-digit standings in most national polls in July to single digits in several recent surveys. In the most recent poll of Iowa — where he has led for most of the summer — he was third behind Trump and tea party underdog Ben Carson, a retired neurosurgeon.

At the same time, Walker has veered to the right on abortion and other social issues, worrying some top backers. Stanley S. Hubbard, a conservative billionaire who oversees a Minnesota broadcasting company and has donated to Walker’s campaign, said the candidate has promised that he would not push a “social agenda” as president and is simply expressing his personal beliefs when asked.

“No one is asking him to change the morals of America.”

“If he’s smart, he will get back to basics and get back to what he did in Wisconsin [and] get off the social issues,” said Hubbard, who had lunch on Tuesday with Walker and other campaign supporters. “No one is asking him to change the morals of America.”

Hubbard strongly opposes one immigration measure pushed by Trump this week: a call to stop giving citizenship to the children of illegal immigrants who are born in the United States. Walker said in an interview Monday that he would support ending birthright citizenship, then said other reforms might make that unnecessary.

Hubbard said that he “might really quickly change my allegiance” if Walker pushed for such a repeal, and that he “did not get a real straight answer” from the candidate at his Tuesday lunch. But Hubbard, who came away ready write more checks to help Walker, added: “I got the feeling that he is not at all anxious to talk about taking away those rights.”

Walker for months has pitched himself as a Washington outsider, but his candidacy has become overshadowed by non-politicians such as Trump, Carson and former Hewlett-Packard chief executive Carly Fiorina, who have connected with voters who are angry at those in office.

Walker said on the conference call Monday that he wants to win over those voters, pitching himself as just as much of an outsider — but one with experience leading a state government.

“Instead of going after Trump, we need to go after his voters,” Walker said on the call. “True frustration — how we handle that is not by knocking him, but saying that we, too, share that frustration.”

Monkey see…

Walker has in recent days adopted the rhetoric of the emerging outsider candidates along with some of their policy positions. Like Fiorina, Walker now says that he is frustrated that the Republican majorities in Washington have not delivered on their promises to voters. Walker said Monday that his immigration stances are “very similar” to those of Trump, who several months ago accused the Wisconsin governor of stealing his slogan “Make America great again.”

Walker also is trying to replicate the feisty anti-establishment tone Trump and others have shown on the campaign trail. The attempt was on full display on Monday morning when Walker spent 20 minutes on the political soapbox at the Iowa State Fair — a rite of passage for those dreaming of becoming president. The appearances regularly attract protesters, and Walker’s experience was no different.

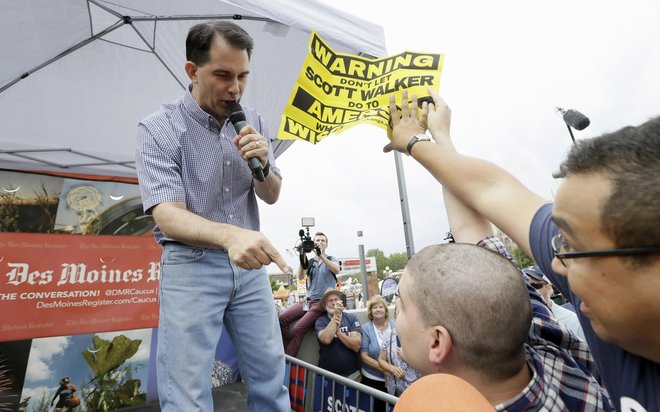

There was shoving in the audience between Walker supporters and liberal activists. There was heckling and booing. Yellow signs popped up in the crowd reading: “Warning: Don’t let Scott Walker do to America what he did to Wisconsin.”

Walker regularly encounters detractors on the campaign trail and usually ignores them. But on Monday, he yelled at one protester in the crowd: “I’m not intimidated by you, sir, or anyone else out there. I will fight for the American people over and over and over and over again. You want someone who’s tested? I’m right here.”

The moment seemed out of character for a candidate who describes himself as “aggressively normal.” But the crowd loved it, and Twitter filled with praise from supporters.

Walker boasted about the interaction later that day during a stop in northern Iowa, although he exaggerated by saying that protesters were rushing the stage. On Tuesday afternoon, the campaign wrote in a mass fundraising e-mail that “the left wing special interests are back with even uglier attacks” against Walker, who “is not shaken easily.”

“People are upset, and they want to see some passion,” said Jonathan Burkan, a Walker fundraiser and financial services executive from New York who was on the Monday conference call. “That can be very positive. It’s important to show people that you can get fired up.”

Anthony Scaramucci, a New York investor and Walker fundraiser who also was on the call, said Walker and his team have quickly recognized that this contest will be much different than previous ones. The electorate is angry, and the campaign reflects that.

“A good candidate has to adapt to what’s going on,” Scaramucci said. “The candidate has to reflect the reality and the circumstances he’s in.”

By Jennifer Agiesta

CNN (8/19/15)

Washington (CNN)Since announcing his campaign in late June, Donald Trump has quickly leapt to the top of the Republican field, leading recent polls nationally, in Iowa and in New Hampshire. And now, for the first time in CNN/ORC polling, his gains among the Republican Party have boosted him enough to be competitive in the general election.

The poll finds Democratic frontrunner Hillary Clinton ahead of Trump by just 6 points, a dramatic tightening since July. Trump is the one of three Republican candidates who have been matched against Clinton multiple times in CNN/ORC polling to significantly whittle the gap between himself and the Democratic frontrunner. He trailed Clinton by 16 points in a July poll, and narrowed that gap by boosting his standing among Republicans and Republican-leaning independents (from 67% support in July to 79% now), men (from 46% in July to 53% now) and white voters (from 50% to 55%).

But Clinton still holds the cards overall in the race for the White House, leading four Republican contenders: She tops Trump and Wisconsin Gov. Scott Walker by 6 points each among registered voters, former Florida Gov. Jeb Bush by 9 points, and businesswoman Carly Fiorina by 10 points.

Clinton maintains this edge in the general election race despite a growing perception that by using a personal email account and server while serving as secretary of state she did something wrong. About 56% say so in the new poll, up from 51% in March. About 4-in-10 (39%) now say she did not do anything wrong by using personal email. Among Democrats, the share saying she did not do anything wrong has dipped from 71% in March to 63% now, and just 37% of independents say she did not do wrong by using the personal email system.

And positive impressions of Clinton continue to fade. Among all adults, the new poll finds 44% hold a favorable view of her, 53% an unfavorable one, her most negative favorability rating since March 2001. A majority of women voters have a positive take on Clinton, 52% view her favorably, and her support among women appears to be the foundation for her general election advantages.

But the fading numbers haven’t hurt her against some GOP contenders. Clinton has her biggest lead over Fiorina, topping her 53% to 43% among registered voters. She leads Bush by a nearly identical margin, 52% to 43%. And Clinton tops both Trump (51% to 45%) and Walker (52% to 46%) by 6 points each.

All of those leads are boosted by sizable gender gaps.

Against Bush, Clinton leads 59% to 37% among women, while Bush holds an advantage among men, 51% Bush to 44% Clinton. Against Fiorina, the only woman among the major candidates for the Republican Party’s presidential nominations, women break 60% for Clinton to 39% for Fiorina, while men are about evenly divided, 48% for Fiorina, 46% for Clinton. The largest gender gap — 34 points — comes in a match-up between Clinton and Trump. Women favor Clinton by 23 points, 60% to 37%, while men break in Trump’s favor by 11 points, 53% to 42%.

At the same time, Clinton’s lead in the race for the Democratic nomination for president is narrowing, and the new poll suggests the best way for the former secretary of state to shift the momentum would be for Vice President Joe Biden to decide to sit this one out. Most Democrats, though, say they’d like to see Biden make a run for the White House.

Overall, 47% of Democratic and Democratic-leaning voters say they support Clinton for the party’s nomination. That’s down 9 points since July, and marks the first time her support has dipped below 50% in national CNN/ORC polling on the race.

At the same time, Vermont Sen. Bernie Sanders has climbed 10 points since July and holds second place in the race with 29%. Biden follows at 14%,former Maryland Gov. Martin O’Malley is at 2%, former Virginia Sen. Jim Webb has 1% and less than 1% back former Rhode Island Gov. Lincoln Chafee.

And though support for Clinton’s nomination bid has slipped, she is the candidate most trusted by Democrats on four top issues, and remains the candidate to beat in general election match-ups.

Should Biden decide not to make a run for the presidency, his supporters would largely flock to Clinton rather than Sanders, boosting her numbers. With Biden’s backers re-allocated to their second choice, Clinton holds 56%, Sanders 33%, with support for O’Malley, Webb and Chafee unchanged.

Among those Democratic voters who are “extremely enthusiastic” about voting for president next year, it’s already essentially a two-person race. Clinton is the choice of 50% of such voters, with Sanders jumping to 38% among that group, Biden at 6%, and O’Malley at 2%.

Still, most Democrats say they do want Biden to make a go of it: 53% of Democrats and Democratic-leaning voters say they think Biden should run, 45% that he should stay out. Even among those who currently support Clinton, 50% say they think Biden should run.

Democratic voters aren’t necessarily convinced a Biden presidency would be better than a Clinton one, though: 35% say Biden would do a worse job as president than Clinton, 27% a better one and 38% say there wouldn’t be any difference between the two. Those who think Biden should run are more apt to say he’d do a better job than a worse one (41% better vs. 18% worse) but a sizable 41% say there ultimately wouldn’t be any difference between the two.

Fewer see Sanders as equivalent to Clinton, more say he’d do a worse job. Overall, 37% of Democratic voters think Sanders would do a worse job as president than Clinton, 31% that he’d do a better job, and 29% that there would be no difference between the two. That shifts among the party’s liberal voters, 41% of whom think Sanders would do a better job than Clinton, 34% think he would do worse than Clinton and 22% that there would be no difference.

Sanders has boosted his favorability rating in the last month, 35% of adults and 58% of Democratic voters have a positive impression of the senator, that’s up from 23% among adults and 36% among Democratic voters since July.

When Democratic voters are asked which candidate they trust to handle the economy, race relations, foreign policy and the income gap between rich and poor Americans, Clinton tops the list each time. Her biggest advantage comes on foreign policy, where 61% of registered Democrats say they trust Clinton over the rest of the field. Biden follows at 22%, and just 9% say Sanders is their top choice here. On the economy, 45% say Clinton would best handle it, 26% choose Sanders and 21% Biden. …